![]()

It has been clear to me for many years that there is no future for the Almighty Dollar. One thing I have noticed is that people are rarely able to perceive the possibility of Change of any sort — whatever the present reality is, that is the way It Has Always Been, and The Way It Will Always Be (cf. 1984 by George Orwell). However, with a little historical perspective, it is very easy to predict the decline and fall of the Dollar.

I have always taken a view of economics which I call “Reality Economics.” I have understood fashionable ideas about how war, for example, can stimulate an economy, but I have always taken an alternative view that actions can be considered in terms of the real effect, and that, ultimately, that real effect will tell far more surely in the long run than any very temporary apparent “stimulation of the economy.” War is the most obvious example of this principle. To be sure, war encourages a host of activities which, superficially, stimulate an economy — arms are built, soldiers are outfitted with uniforms and guns, ships are built for transport, and military spending all along the line flushes the economy with movements of capital. Yet when the final effect of all of these wartime activities is to destroy — people, bridges, buildings, oil fields — it is clear to me that all of that expenditure of money will promote the advance of poverty, not prosperity.

Then even more money is spent to rebuild what was destroyed at such cost, and huge armies of contractors, masons, electricians, and speculators will be mobilized in the shadow of the soldiers, all of whom appear likewise to “stimulate the economy.”

But in contrast with all of this destructive and useless consumption of real value, consider the effect of spending upon projects for which there is a more clearly evident value — schools, hospitals, roads, agriculture, etc. My “reality economics” suggests that such expenditures will eventually bring very real and tangible benefits.

What is required is to distinguish between short term appearances and long term reality. I am not at all impressed by any of the specious arguments that pretend to find an economic stimulation in warfare and other examples of destructive and wasteful energy. Extend the window to a longer term, and sooner or later you will see the actual consequences of wasteful economic activity (and the benefits of economic activity which actually accomplishes something worthwhile). I take as a prime example the ancient civilization of Crete, which enjoyed a higher civilization than is in evidence anywhere in the world at the present day, yet it enjoyed this civilization thousands of years ago, one of the earliest sites of advanced civilization known to history. The reasons for the advanced level of civilization are very clear and simple. Crete was an island of just the right size — big enough for a large and complex community to develop, yet small enough to be governed by a single king, so there was no internal warfare. In addition, and most importantly, as an island nation it was easily defensible from external attack. Thus, it enjoyed an uninterrupted period of peace and tranquility for over a thousand years. This peace allowed the citizens to attend to the cultivation of their gardens, and allowed an attendant class of merchants and artisans to grow up around the agricultural base. This led to prosperity for everyone, and that prosperity led, in turn, to the development of music, arts, and sciences for the better appreciation of life, and the civilization was rolling right along, flourishing and flowering in every respect.

This civilization lasted until the advent of large ships of war, when it became possible for foreign powers to invade their land with an armada of ships carrying armies of soldiers, who immediately laid waste to the land, raping and pillaging, seizing whatever they could find of value to carry off. The civilization of Crete was destroyed overnight.

So if a thousand years of uninterrupted peace leads to prosperity and the advance of civilization, times of warfare will do the opposite, quickly dragging down any nation based upon warfare into the mire of poverty and cultural devastation.

The United States has entered upon the last stage of a Great Power. Early stages of decline are marked by extensive military expenditures which impoverish the land and the people, and an abandonment of those commercial activities which produce real wealth and prosperity.

The increasing dependence upon military activities “to promote and stimulate economic activity” has led to a state of affairs in which very little of real economic value is actually produced in the United States any more. As far as commercial goods are concerned, everything is now made in China. Even the fabled Technology sector is increasingly outsourced to India. This is leaving the country without any real economic base any more, so it is no wonder that it is rapidly descending into poverty.

Furthermore, its agricultural base is eroding just as rapidly. When the fertility of agricultural lands is destroyed by the over-use of chemicals, replacing organic farming practices, then the sterile medium of ruined land can no longer support life without a continued and increasing dependence upon such chemicals, which leads to a downward spiral of decreasing productivity, measured not only in the quantities produced, but especially in the nutritional value of the produce. Of what value is it to produce bushels of vegetables which contain no more nutritional content than the chemicals of which they are composed? It is far healthier to eat a small meal of organic produce which provides a true and nourishing vitality than to eat a big plate of food which is saturated with chemicals, and devoid of any of the attributes of life.

It has always amused me to watch people rejoicing in the constant rising of the values of the stock market. They seem to think that the rising values of their stocks indicates some real economic growth. Sadly, it is just the reverse. The rise in the value of stocks, like the rise in the “value” of real property, is just another way of looking at the fall of the dollar. For example, if stocks or property increase in value by 30%, yet the value of the dollar declines by 30%, this represents zero growth. And make no mistake — the dollar has been declining rather quickly for many years now! All of this has been quite clear to bankers and financial speculators, but the common people, hoi polloi, are lulled into thinking that nothing unusual is going on. “Sure, markets rise and fall, and the value of the dollar rises and falls.” Only at present it is only falling, and not doing too much rising at all. One very simple benchmark is the value of the Euro. When the Euro was introduced, it started off at par with the Dollar. Now, a dollar will buy you about 70¢ on the euro, representing a loss of about a third of the value of the dollar over a handful of years, and there is no end in sight.

Every day I read about falling markets in the US, and historically high markets in China and India. Just about every currency in the world is outpacing the dollar. Recently I was in Cambodia and speaking with hotel keepers who were accumulating piles of local money and they wanted, in their innocence, to convert their savings into dollars. I told them, to their evident surprise, that they should rather hold on to their savings in Cambodian currency. I suggested that, in a few years time, savings of Cambodian currency would be worth considerably more than equivalent savings in dollars.

The fact is, no one with any economic sense wants to hold dollars anymore! Even the Chinese bankers, aware of the inevitable decline of the value of the dollar, are very reluctant to renew loans denominated in dollars. Of what use is it to earn 6% interest on a loan if the loan is paid back in dollars that have lost 10% of their value? But if American banks were forced to accept loans denominated in any strong currency, such as the Chinese yuan, or the Indian rupee (hilariously enough, from the standpoint of fairly recent history — when I was traveling in India, in the days of my youth, the rupee had no value whatsoever outside of India), then the imminent bankruptcy of the American banks would be assured.

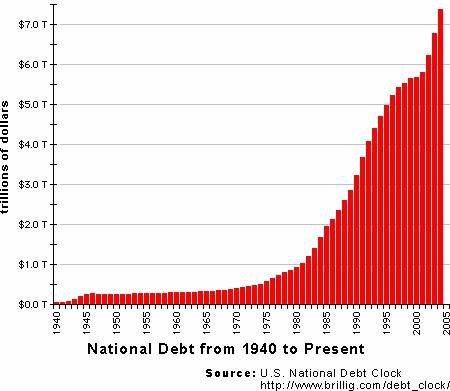

In fact, the American National Debt is so huge that there is no mathematical possibility that it could ever be repaid. What? Did you follow that? Look at the rise in the debt from 1940 until the present —

Is there a mathematician in the house? Does anyone recognize the shape of that curve? It is an exponential curve. What that means is that, from here, there is no way it can go but up, dramatically and stratospherically, far beyond the remotest possibility that it might ever be repaid. In fact, did you ever wonder how the United States is financing its war in Iraq? It is simply borrowing the money and piling it onto the National Debt, which everyone understands will never, ever, be repaid. The National Debt is a game of musical chairs — bankers and merchants go on making money as long as the music plays, but when the music stops, you had better not be holding any dollars (or bonds payable in dollars)!

(Update, March, 2011) That graph is out of date. Here is the way it looks about five years later, just in case anyone was wondering what happens to an exponential curve: [December, 2017 - $20 trillion and counting fast. December, 2021 - $29 trillion. 2024 - $35.6 trillion].

The Chinese bankers backed down, and allowed the American banks to go on repaying their loans with ever more worthless dollars, because they, like everyone else, are apprehensive about what will happen “when the music stops.” But for now, the band is playing on, even though the game has become ever more and more unreal. Do you understand how it is that so many people and corporations are able to make so much money off of this war in Iraq? It is perfectly simple. What you do is get a contract from the American Government, which borrows, say, another billion dollars to give to the Contractor. Then the Contractors vaporize $900 million, and put the final $100 million into their pockets. Voila, “free money”! To be sure, a billion dollars has been piled onto the National Debt, but that is all an unreal fantasy anyway, yet the hundred million is real money in the pocket. Let the band play on!

Well, while governments and contractors are playing this game, stuffing money into their pockets as fast as they can before the music stops, what is actually going to happen? If the National Debt is just a fantasy, which “everyone” (the “smart money”) understands will never be repaid, what is going to happen? Can the levels of the National Debt just go soaring on and on to ever more unreal and lofty heights?

Well, no. No; the hard truth is that it cannot. The music is still playing on, but ever more and more you have the “smart money” managers glued to their computer monitors, watching for the signs of the music stopping. What happens is that declines in the financial markets can be very sudden and very brutal. The secret is to make money in this high-stakes game as long as you can, and then, when the music stops, be very sure that you are out of dollars, and out of any bonds payable in dollars! You can own tangible assets, like real property, but God help you if you have sunk the money from the sale of Grandma’s farm into the bank, or paper securities! (I am not troubled by the collapse in the real estate market these days — editing this article in 2008. When Asian residents discover how cheap land is in the United States, relative to the cost of land in their own countries, they will bid up the prices of the land once again.)

Fundamentally, there are really only two ways out of this situation. One of them is through warfare. The ultima ratio regis (“last argument of kings”) is their canon. When a nation is going broke, the simple and obvious solution is to put your last remaining resources into fitting out your citizens for war. Then you can simply march into foreign lands, raping and pillaging, and bring home whatever you can carry off of value, just as the marauders who sacked ancient Crete did so many years ago. This is no longer a politically correct solution, however. In earlier days, this solution was so common that no one expected anything any different. Of course your neighbors would be marching over the border to seize your lands any time they feel they can get away with it. This is just the law of the jungle, after all, so what else is new?

Unfortunately, however, the law of the jungle is antithetical to any of the tenets of modern civilization. Having recourse to wars of aggression is to renounce any claims to civilization, and hasten a regression back to very primitive morality.

There is, however, one other little possibility, which has not escaped the notice of sharp bankers! There is, finally, a way to actually pay off that National Debt after all! The key, as the Chinese bankers so clearly understand, is to repay your loans with “dollars” of reduced value. Just to give you a simple idea, suppose agents of the US government (having first sheltered all of their wealth into real or tangible assets — real property, gold, diamonds, works of art, Indian rupees, etc.) decide that the time is ripe to shut off the music. Trying to take advantage of some brief window in which no one is expecting it, they suddenly pull the plug. When you read the morning paper over your toast and coffee, you might discover that, in the night, the US government has paid off the National Debt! What they did was to print up big stacks of billion-dollar bank notes, and pay everyone off! Perfectly legal. Now, of course, a hamburger will cost half a million dollars, but that is no longer the concern of the federal government, which has paid off its debt in full!

But that amusing little story is not the way it actually happens. What they do, instead, is nibble away at the value of the currency a little at a time, “so that no one notices.” But what this means is that the fall of the dollar is very far from over. You may depend upon it that the dollar will continue to collapse, a little at a time, probably with a series of rapid falls, with brief leveling off periods in between, for the foreseeable future, as the United States gradually recedes from its position of dominance on the world’s stage to take up the more humble role of the has-been, drinking beer with the Romans, Mongols, Spaniards, Englishmen, and Russians who have been there before them.

This, of course, is the “optimistic” scenario. The somewhat more pessimistic scenario would see escalating war on all fronts — Iraq, Iran, Pakistan, Korea, etc. Perhaps it is the deliberate intention of the cabal of wealthy and powerful people, fronted by the Bush regime, to ratchet up the levels of tension and fear in the world to the point where they can safely rule by martial law, bringing the world to the brink of chaos and annihilation until they can find a way to re-shuffle the deck in their favor. If they do this, of course, do not look to them to bail out the United States government, which is hopelessly bankrupt and has been for many years — no, they will go on lining their own pockets, bailing out of the sinking ship just as it is going down.

Oh, no — the former “optimistic scenario” of the gradual decline of the United States and its god, Mammon (the Almighty Dollar) is a much more graceful way for that vortex of negative energy to subside into irrelevance.

So the moral of this story is “don’t be the last one to get out of dollars!” Dump your dollars now, and avoid the rush. Perhaps it is time to start hoarding rupees (or guns, depending on whether you are an optimist or a pessimist).

There is a positive side to this essay. If a major change of energy can take place, and a rapid uplifting of spiritual consciousness can spread throughout the land, then, in the rapid movement back to Clarity, a great prosperity may take the place of war, and (as a rising tide floats all boats) even the United States economy and the greenback Dollar may again reflect the value of prosperity.

![]()